WHAT WE LEARNED INTO OCTOBER: CONSTRUCTION INDUSTRY POWERS INTO FOURTH QUARTER

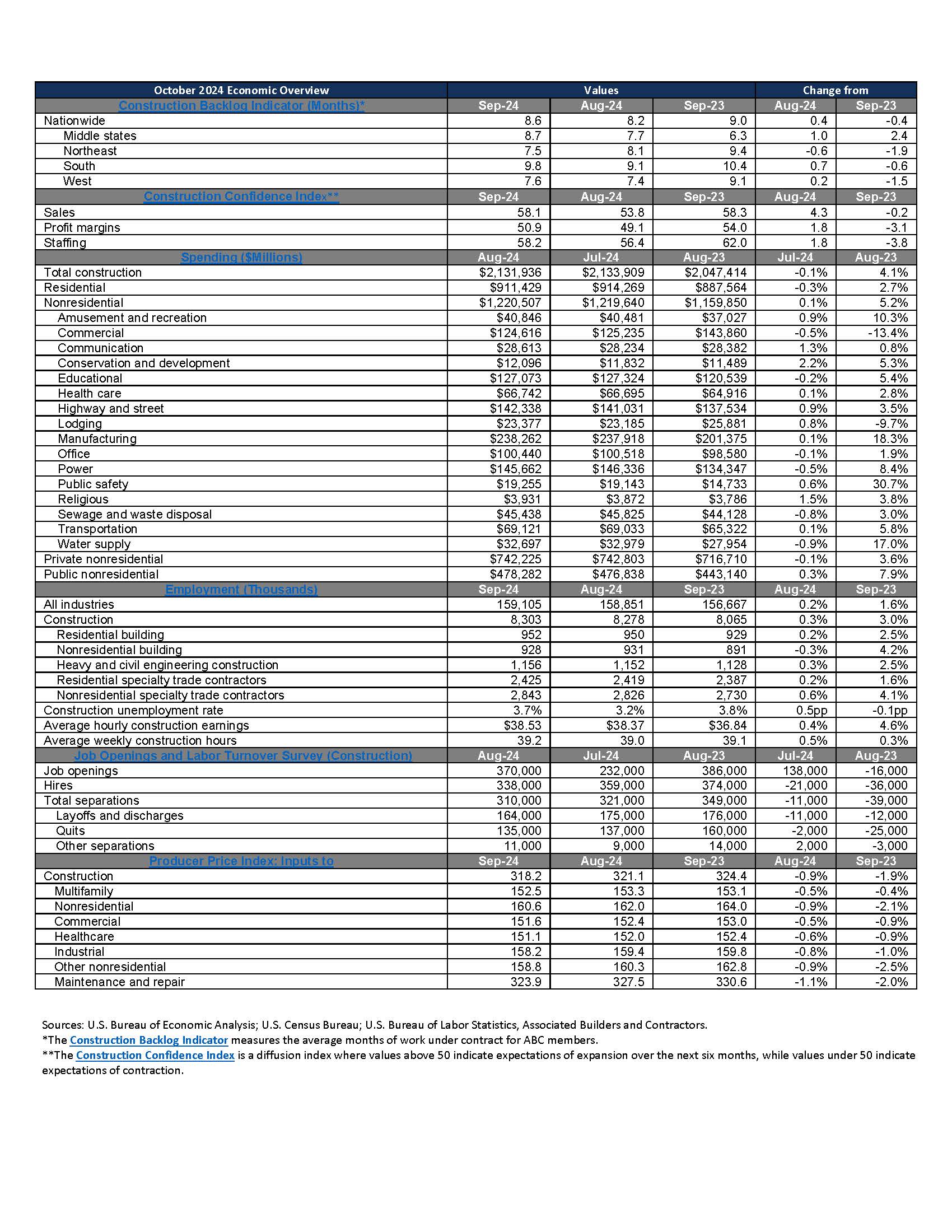

Construction industry dynamics held steady in September. Contractors keep hiring, and manufacturing and infrastructure investments continue to ramp higher, while labor remains scarce and the residential segment, along with certain nonresidential categories, struggle to gain momentum.

CONSTRUCTION SPENDING DYNAMICS UNCHANGED

Nonresidential construction spending inched higher in August and is up 5.2% over the past year. That’s largely due to ongoing manufacturing megaprojects and continued activity in infrastructure-related categories like highway and street and water supply. Office and commercial, which are nonresidential segments particularly susceptible to high interest rates, both exhibited monthly declines and have struggled over the past year.

INDUSTRY EMPLOYMENT GROWS

Construction industry employment increased for the fifth straight month in September, with job gains concentrated in nonresidential segments. Hiring would likely be faster if not for ongoing labor shortages; while the industry unemployment rate increased to 3.7% for the month. That’s still lower than at any point on record before the second half of 2018.

BACKLOG AND CONFIDENCE REBOUND

ABC’s Construction Backlog Indicator increased to 8.6 months in September. That’s up 0.4 months from August but is still 0.4 months below the September 2023 level. All three components of ABC’s Construction Confidence Index improved in September, with the reading for profit margins edging back above the threshold of 50, indicating that on net contractors expect greater profitability over the next two quarters.

MATERIALS PRICES DECLINE DUE TO LOWER OIL PRICES

Construction input prices fell in September, but that’s almost entirely due to lower gas prices. Prices for certain materials like gypsum, asphalt, lumber and some metal products increased sharply for the month. While materials prices are in aggregate still lower than one year ago, emerging pressure on global supply chains could put upward pressure on prices in the coming months.

LOOKING AHEAD

Despite the Federal Reserve lowering the target range of the federal funds rate at its September meeting, it will require several months, as well as additional rate cuts, before lower borrowing costs bolster construction activity. In the meantime, federally funded and federally incentivized projects will keep nonresidential spending at or near the highest levels on record.

SEE THE PDF VERSION BELOW