2018 Canadian Construction Outlook

In the fall, Bank of Canada Governor Stephen Poloz characterized the country’s economy as having its head in the oven and feet in the freezer. Going into 2018, Dodge Data & Analytics Senior Economist Richard Branch agrees, noting during the Dodge Construction Outlook Executive Conference held in November that a mixture of positive and negative macroeconomic factors should lead to a 2.5 percent annual increase in GDP this year.

Positive drivers include increased business investment, the stabilization of oil prices, a strengthening labor market, federal stimulus spending, small business tax cuts and healthy demographic growth, while headwinds include tightening monetary policy, a slowing housing market, high levels of consumer debt, a stronger Canadian dollar and the potential demise or renegotiation of the North Atlantic Free Trade Agreement (NAFTA).

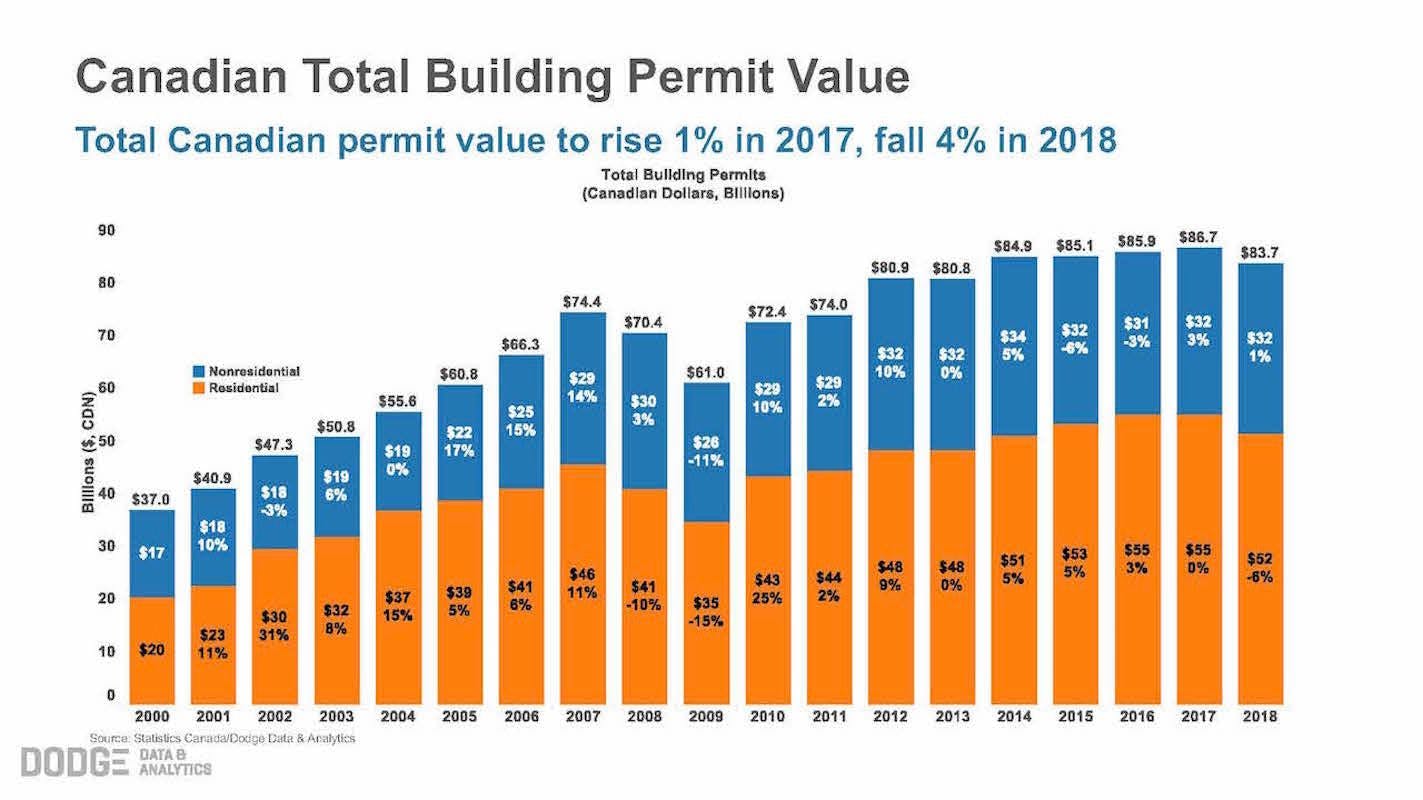

Following Canadian GDP growth in the neighborhood of 4.7 percent in the first half of 2017—leading every G7 nation—Branch forecasts a broad-based easing of economic growth in 2018. For the construction industry specifically, total permit values are expected to fall 4 percent in 2018 after rising 1 percent in both 2016 and 2017.

On the residential side, Branch reports single-family permits will weaken through 2018 due to overheated multifamily markets, with British Columbia and Ontario bearing the brunt of the decline. Meanwhile, home prices are cooling in Toronto and moving higher in Vancouver.

Setbacks in the commercial market in 2017 will lead to 2 percent growth in 2018, while the institutional market will remain flat this year on the heels of a steep 10 percent increase last year. Notably, the institutional sector would be up 2 percent if not for a pullback in health care construction.

Following are Branch’s predictions for other nonresidential sub-sectors.

- E-commerce continues to drive the warehouse market, and permits should increase 2.1 percent in 2018 as vacancy rates head lower.

- Office permit values will hit a nine-year low in 2018, falling 1 percent to $4.5 billion. Vacancy rates are improving in Toronto and Vancouver, while more than a quarter of all office space is vacant in Calgary.

- Manufacturing permits are expected to increase 3 percent in 2018 to $2.4 billion; however, renegotiating NAFTA is a major risk to the forecast.

- The education sector will post an 8 percent gain in permits in 2018 due to healthy demographic growth, particularly in the K-12 age group, as well as improvements in provincial budgets.

- Health care permits should decline 27 percent in 2018 to $1.5 billion following a 47 percent increase in 2017 fueled by large projects in three provinces.

Joanna Masterson was a writer and editor for Construction Executive for more than a decade.

Related stories